Regulation A+ offerings have been generating widespread buzz in the crowdfunding world, promising companies a new avenue for capital raising. But is this regulatory framework truly all it's cracked up to be? Some industry experts argue that Regulation A+ offers a game-changer in the crowdfunding landscape, while others advise against blindly embracing this new paradigm.

Ultimately, the success of Regulation A+ offerings hinges on a number of factors, including the viability of the companies seeking funding, the sophistication of the crowdfunding marketplace, and the financial capacity of the contributors.

While Regulation A+ presents some advantages for both companies and investors, it's crucial to conduct thorough due diligence and understand the risks involved before participating capital.

A+ Securities Offering from Morrison & Foerster

Regulation A+, also known as Reg A+ or simply A+ securities offerings, presents a unique path for companies to raise capital in the United States. This offering framework, governed by the U.S. Securities and Exchange Commission (SEC), allows private companies to issue their securities to the general public without requiring a traditional initial public offering (IPO). MOFO, or Morrison & Foerster, is highly regarded in its expertise in navigating intricate securities regulations. Their seasoned legal team provides comprehensive guidance and support to companies looking to leverage the benefits of Regulation A+ offerings.

Jumpstarter ignite

Jumpstarters are awesome tools for {bringinglife to your projects. Whether you're a serial entrepreneur, a jumpstarter can help you get past roadblocks. They're like a jump-start for your ideas, helping them take flight. Jumpstarters can come in many forms - from {crowdfunding campaignsto passionate communities to mentors and coaches who offer invaluable advice and wisdom. So if you've got a great idea that needs a little extra push, consider using a jumpstarter to help you get where you want to go.

Break down Title IV Regulation A+ for Me | Manhattan Street Capital

Title IV Regulation A+ is a section of the Financial Code that enables companies to raise capital through offerings. Manhattan Street Capital works with helping companies navigate this difficult regulatory framework. Their guidance can assist companies in meeting the requirements of Regulation A+ and successfully complete their funding initiatives.

- Enables| unique opportunities for companies to raise capital.

- Manhattan Street Capital provide valuable information for companies considering Regulation A+.

- Before launching a Regulation A+ offering, it's important to engage| experienced professionals like Manhattan Street Capital.

Modern Reg A+ Solution

Looking for a streamlined with innovative path to raise capital? A groundbreaking Reg A+ solution may be just what you need. This powerful fundraising mechanism allows companies to access public markets with simplicity. Our team of consultants can guide your company through the entire process, from filing to investor relations. We'll help you leverage the complexities of Reg A+ and unlock new opportunities for growth.

- Expose Your Company's Potential

- Streamline Your Fundraising Efforts

- Connect With a Wider Investor Base

What Are Regs- We've Got Every One

Regs are the foundation of everything. They can be simple or intricate, but they always serve a purpose. Some regs are about safety, while others are about smooth running.

- We've got regs for communication

- Regs for storing information

- And even regs for rest periods!

Accessing Capital With Regulation A+

Regulation A+, also known as Reg A+, is a unique fundraising mechanism that allows startups to raise capital from the public. It presents a viable avenue for businesses seeking to expand their operations, launch new products or services, and achieve sustainable growth. Unlike traditional funding sources, Reg A+ offers startups the ability to attract investments from a wider range of investors, including individuals, entities. This broader investor base can provide startups with not only financial resources but also valuable connections and mentorship.

Before embarking on a Reg A+ offering, startups need to carefully consider the guidelines imposed by the Securities and Exchange Commission (SEC). Compliance with these regulations is crucial to ensure a successful offering and avoid potential penalties. Startups should also consult with experienced legal and financial professionals who specialize in Reg A+ to navigate the complex process efficiently.

A well-structured Reg A+ offering can be a transformative tool for startups, enabling them to access the resources needed to scale their businesses and achieve their full potential.

How Regulation A+ Works with Equity Crowdfunding

Regulation A+, a provision within U.S. securities law, offers a mechanism for publicly traded companies to raise funds from the masses. In essence, it serves as a bridge between traditional funding methods and the burgeoning realm of equity crowdfunding. This structure allows companies to issue securities to a wider pool of investors, possibly exceeding the limits imposed by conventional crowdfunding platforms.

- Companies leverage Regulation A+ to

- increased accessibility to capital from the public

- Regulation A+ distinguishes itself from traditional crowdfunding platforms by eliminating funding caps and facilitating substantial capital raises for companies.

{Despite its potential advantages, it's crucial to recognize that Regulation A+ entails a more rigorous approval process compared to standard crowdfunding platforms. Companies must comply with specific disclosure requirements and undergo an comprehensive evaluation by the Securities and Exchange Commission (SEC). This strict process aims to protect investors while ensuring that companies comply with

Regulation A Plus FundAthena

FundAthena is a innovative platform leveraging the power of Regulation A Plus to facilitate access to funding for startups . By utilizing this structure , FundAthena aims to connect capital providers with promising enterprises across a broad range of industries. The platform's focus to transparency and thorough review provides investors with the confidence needed to make informed investment decisions.

Its objective is to simplify access to capital, fostering a more inclusive financial ecosystem.

A Blank Check

A blank-check company is a special purpose acquisition corporation often referred to as a SPAC. These entities are formed with the sole aim of raising capital through an initial public offering (IPO) for the sake of acquiring an existing private company. Essentially, they offer investors a opportunity to be part of the growth of a private company without directly knowing the target company.

When a SPAC successfully completes its IPO, it has a brief timeframe to identify and acquire a fitting business within a specific industry or sector. If the SPAC fails a suitable acquisition within this timeframe, it must dissolve itself.

Colonial Stock Securities

The rise of colonial stock securities in the early|17th century marked a significant shift in the dynamics of commerce. These assets offered speculators the opportunity to engage in the expansion of colonies, often through funding essential endeavors. The uncertainty inherent in such ventures was tempered by the potential for substantial returns, attracting both local and overseas capitalists.

We Found A Reg!

We after ages got our hands on a awesome reg. It's totally bonkers. I can't stand still to take it for a spin. This thing is going to rock our world.

Title IV Reg A+ Explained

Dive into the exciting world of Title IV Reg A+ crowdfunding with our latest infographic! This detailed visual guide will explain the key aspects of this unique fundraising mechanism, assisting you to comprehend its potential. Discover how Reg A+ can drive your business growth and connect investors with your vision.

- Gain a detailed understanding of Title IV Reg A+

- Explore the advantages of this fundraising strategy

- Illustrate key information in an clear format

Don't miss out on this essential resource!

Investment Offerings - Securex LLC

Securex Filings LLC is a leading guidance on Regulation A+ securities offerings. With a team of experienced securities professionals, Securex Filings guides companies through the complex process of conducting a Regulation A+ transaction, meeting all regulatory requirements.

They offer companies, facilitating their capital raising efforts.

Find Your Next Funding Venture

Crowdfund.co is a/offers/provides platform/marketplace/hub where entrepreneurs/creators/innovators can raise funds/secure investment/launch campaigns for their ideas/projects/endeavors. With a wide/diverse/extensive range of categories/industries/sectors, crowdfund.co connects/links/pairs backers/investors/supporters with promising/exciting/innovative ventures, facilitating/enabling/supporting the growth and development of startups/small businesses/independent creators.

Whether you're/You might be/Are you looking to fund/launch/support a creative/technological/community-driven project, crowdfund.co offers/provides/delivers a user-friendly/intuitive/accessible experience/interface/environment.

Explore/Browse/Discover various/multiple/numerous campaigns, connect/interact/engage with creators/developers/visionaries, and be a part of/contribute to/support the future/innovation/progress of entrepreneurship/creativity/technology.

The Fundrise Reg A+ Offering

Fundrise's investment platform is a popular way for investors to gain access to non-traditional real estate investments. The company allows individuals to own pieces of a variety of mixed-use properties across the United States. Fundrise's seeks to provide investors with a diversified portfolio that generates consistent cash flow.

- Investors canopt for various investment products based on their risk tolerance and financial goals.

- Investors have access to regular investment dashboards to track the development of their investments.

- Fundrise's Reg A+ offering has become a widely recognized trend in the real estate investment industry, allowing for greater accessibility to these types of investments.

The and Exchange Commission

The Financial Regulator is a government agency that regulates the financial instruments industry in the American marketplace. Its primary purpose is to safeguard investors, foster fair exchanges, and encourage capital formation. Established in 1934, the SEC has a broad authority that includes matters such as registration of securities offerings, prosecution of fraudulent activity, and implementing accounting and transparency requirements.

Shares Crowdfunding Title IV Reg A+

CrowdExpert's Title IV Reg A+ marketplace is a revolutionary way for companies to secure capital from the crowd. This system allows companies to provide shares directly to supporters in return of a stake in the company.

- Pros of using CrowdExpert Title IV Reg A+ encompass:

- Increased availability to capital

- Company awareness and exposure

- Investor building and engagement

CrowdExpert Title IV Reg A+ provides a clear process for both companies and investors, making it a viable option for expansion.

Testing the Waters

Before diving headfirst into a new situation, it's often wise to gauge the waters first. This involves gradually dipping your toes in, assessing the current and identifying any potential roadblocks. By gathering valuable insights, you can formulate a more informed approach. This process of discovery helps minimize risks and increases your chances of success.

Crowdfunding for everyone

Crowdfunding has exploded in popularity, offering a fresh way to fund projects big and small. While it's been used by individuals and startups for years, lately crowdfunding is becoming increasingly accessible to the everyday person. This shift means that anyone with an idea can now potentially raise the funds they need to bring their vision to life. From creative endeavors like filmmaking to community initiatives such as building a playground, crowdfunding empowers individuals to take control of their destiny. With platforms making it simple than ever to launch a campaign, the potential for funding anything is truly limitless.

StreetShare Successful Fund-raising Using Regulation A+

StreetShares, a prominent player in the finance industry, recently made headlines with its impressive money raising campaign utilizing Regulation A+. This innovative approach to gathering capital allowed StreetShares to tap into a broader pool of investors, ultimately increasing its {financial{resources|strength. By leveraging Regulation A+, StreetShares was able to attract millions of dollars from individual investors, demonstrating the growing acceptance of this {regulatory{framework|mechanism within the private investment landscape.

The SEC's Equity Network

SEC EquityNet is a/serves as/acts as an online platform developed by/created through/launched by the United States Securities and Exchange Commission (SEC). Its primary goal is to/function is to/objective is to facilitate the offering of/access to/investment in private company securities for/to/with a wider range of investors. EquityNet provides a/offers a/presents a secure and regulated/compliant/vetted environment where/in which/on which companies can list their/offer their/raise capital through equity crowdfunding, connecting them with/bringing together/pairing them with potential investors/financiers/backers.

Investors on/Users of/Members within EquityNet have the opportunity to/ability to/chance to research/discover/explore a diverse/wide range/variety of investment opportunities across various industries/different sectors/multiple markets. The platform also offers/furthermore provides/includes educational resources/helpful tools/informative content to educate/assist/support investors in making/with their/for informed investment decisions.

A look at Regulation A+ Offerings on Investopedia

Regulation A+ offerings are a method of raising capital for companies that fall under the Securities Act of 1933. This relatively new regulation, introduced in 2015, provides a streamlined and less expensive process compared to traditional IPOs or private placements. Investopedia serves as a valuable platform for investors seeking about Regulation A+ offerings, providing comprehensive explanations on the regulations, benefits, and potential risks involved.

A key advantage of Regulation A+ offerings is their accessibility to a wider range of individuals. Unlike traditional IPOs, which are typically reserved for institutional investors, Regulation A+ allows both accredited and non-accredited investors to participate. Investopedia's articles delve into the specific requirements and qualifications for both types of investors, ensuring transparency and clarity throughout the process.

Furthermore, Investopedia offers a wealth of data on the various stages involved in a Regulation A+ offering, from application with the Securities and Exchange Commission (SEC) to the distribution of securities to the public. Investors can gain valuable insights into the due diligence process, legal frameworks, and financial projections typically associated with these offerings.

- Furthermore, Investopedia provides a list of companies that have executed Regulation A+ offerings, offering investors real-world examples and case studies to learn from.

- The platform also features expert opinions on current trends and developments in the Regulation A+ market, keeping investors informed about potential risks and regulatory changes.

Overall, Investopedia's dedicated coverage of Regulation A+ offerings presents a comprehensive and accessible resource for both novice and experienced investors seeking to navigate this increasingly popular method of capital formation.

Regulation A+ Organizations

A+ companies are often lauded for their exceptional track record of responsible practices. As a result, regulatory bodies tend to impose tailored guidelines on these entities. This approach aims to foster continued innovation and growth while minimizing potential risks. However, it's crucial to strike a balance between flexibility and responsibility. Overly lax regulations could lead to deregulation, while overly burdensome rules could hinder the very progress that these companies exemplify.

Governance A+ Summary

Regulation shapes a pivotal role in shaping the scene of any industry. A+ guidelines for regulation guarantee that businesses conduct ethically and accountably. Effective regulation aims to mediate the interests of consumers, businesses, and society as a whole.

By establishing clear rules and guidelines, regulators have the ability to mitigate risks, promote innovation, and defend public welfare. Conformance to high levels of regulation results in a greater trustworthy market, as a result benefiting all parties.

Supervision + Real Estate

The convergence of strict/comprehensive/robust regulation and the dynamic real estate/property/housing market presents both challenges and opportunities. Regulators/Government agencies/Supervisory bodies must strike a delicate balance between ensuring/promoting/safeguarding transparency, consumer protection, and fair practices while fostering/encouraging/supporting investment and sustainable growth in the sector. Key/Essential/Fundamental regulatory frameworks often encompass areas/aspects/domains such as property transactions/deals/sales, financing/lending/mortgage practices, land use/zoning/development, and environmental/sustainability/green building considerations.

Effectively/Successfully/Diligently implementing these regulations is crucial for building/establishing/creating a stable/reliable/transparent real estate market that benefits both/all/various stakeholders. Furthermore/Additionally/Moreover, ongoing monitoring/assessment/evaluation of regulatory policies and their impact on the industry/sector/market is essential/crucial/vital to addressing/mitigating/counteracting emerging risks and adapting/evolving/transforming to a changing/dynamic/ever-evolving landscape.

Our Mini-IPO First JOBS Act Company Goes Public Via Reg A+ on OTCQX

It's the momentous occasion/day/moment for our company as we officially go public/launch on the market/debut via Regulation A+ on the OTCQX marketplace. This signifies a significant milestone in our journey, marking the culmination/the beginning of a new chapter/a major step forward as a publicly traded/listed/registered entity. The JOBS Act has been instrumental in enabling smaller companies like ours to access the capital markets {more easily/withouttraditional barriers/extensive regulations. Our dedicated team/passionate employees/hard-working staff have worked tirelessly to bring this vision to reality/fruition/life, and we are excited to share this success with our investors/shareholders/supporters.

We believe that listing on the OTCQX will provide us with increased visibility/exposure/recognition, allowing us to connect with a wider range of investors/potential partners/a broader audience and ultimately fuel growth/accelerate expansion/drive innovation. This is just the beginning/the first step/a major leap forward in our journey, and we are confident/optimistic/excited about the future.

FundersClub facilitates Reg A+ fundraising on the website

FundersClub, a popular platform for connecting investors with promising startups, is now extending its services to include Reg A+ campaigns. This new feature allows companies to {access a wider pool of investment by selling equity directly to the public. With this development, FundersClub aims to streamline access to funding for startups of all types.

- This move comes as a reversal to the growing demand from both companies and investors for more inclusive fundraising options.

- FundersClub's Reg A+ service is designed to be user-friendly and provide companies with the guidance they need to launch a successful campaign.

Securities Law What is Reg A Plus

Regulation A+, often IPO referred to as Reg A Plus , is a provision of securities regulation in the United States that enables companies to raise capital from the general public . This exemption from certain registration requirements under the Securities Act of 1933 provides smaller, non-reporting companies with a more affordable path to securing public funding.

A key feature of Reg A+ is its tiered structure, allowing companies to raise up to $25 million in capital under Tier 1 and up to $75 million under Tier 2. Companies that choose Reg A+ must still follow certain disclosure requirements, including filing a detailed offering statement with the Securities and Exchange Commission (SEC).

Supervising A+ Crowdfunding Platforms

The booming realm of crowdfunding, particularly within the A+ category, demands stringent regulatory frameworks. These platforms support innovative projects and entrepreneurial endeavors, but they also present risks for both investors and entrepreneurs. Stringent regulations are vital to guarantee investor confidence while encouraging a healthy and sustainable crowdfunding ecosystem. To accomplish this balance, regulators must carefully consider the distinct features of A+ crowdfunding platforms and craft regulations that are both supportive. Aclear regulatory framework can minimize risks, improve transparency, and finally contribute to the long-term prosperity of crowdfunding.

Regulation A+ IPO

Launching an IPO through Regulation A+, a company can garner investment from the wider marketplace. This framework allows companies to list their shares without the exacting standards of a traditional IPO.

- Regulation A-Plus IPOs offer companies a simpler path to capital formation.

- In contrast traditional IPOs, Regulation A+ allows companies to disclose information in a less formal manner.

- Reg A+ provides stakeholders with an avenue for involvement in early-stage companies .

Although the advantages, it's essential for companies considering a Regulation A+ IPO to perform comprehensive research . This includes understanding compliance protocols and ensuring financial stability.

Reg A+ Offerings

Regulation A+ offerings present a compelling pathway for businesses to raise funds. These guidelines, established by the Securities and Exchange Commission (SEC), allow companies to offer securities to the public without the strictures of a traditional initial public offering (IPO). A key advantage of Regulation A+ is its simplicity for smaller companies, making it a favored option for raising capital.

To guarantee compliance with Regulation A+, companies must comply with specific provisions. This encompasses filing a detailed offering statement with the SEC, providing ongoing disclosures to investors, and exercising careful scrutiny. Successful Regulation A+ offerings can provide significant benefits for both companies and participants, fostering capital formation.

Regulations for Offering

When considering rules surrounding submitting , it's essential to conform with all relevant provisions. These requirements can vary depending on the nature of your service and the jurisdiction in which you conduct.

To guarantee compliance, it's crucial to thoroughly research the detailed rules that apply your circumstances. This may involve reaching out to legal professionals for clarification.

A comprehensive understanding of the rules will help you navigate potential issues and preserve a lawful offering.

Tackling Regulation in Crowdfunding

Crowdfunding platforms have become a popular method for individuals and organizations to secure funds. However, the environment of crowdfunding regulation is constantly evolving. Contributors need to be cognizant of the rules that oversee crowdfunding campaigns to minimize risk and guarantee a positive fundraising endeavor.

Regulations often fluctuate depending on the type of crowdfunding approach, the amount of capital being sought, and the jurisdiction where the campaign is conducted. Networks may also have their own distinct set of rules mandating project conduct.

It is vital for both initiators and backers to conduct thorough research to comprehend the relevant regulations. Materials such as government websites, industry bodies, and legal consultants can provide valuable information. By tackling the regulatory aspects of crowdfunding with precision, stakeholders can foster a safe and efficient fundraising sphere.

Showcase your expertise

SlideShare is a platform where you can publish your visual content. It's a great way to network with other professionals. Whether you're demonstrating educational materials, SlideShare offers a powerful platform to impact a diverse audience. You can {easily{ upload, embed, and even monitor the impact of your presentations.

Regulation A+ Offering

The Jobs Act of 2012 introduced/created/established Rule 506(c) of Regulation D and introduced a new securities exemption called Regulation A/Reg A/Regulation A Tier 2 which provides a more flexible/streamlined/accessible path for companies to raise capital publicly/privately/through the public markets. Under Reg A Tier 2, companies can offer up to \$75 million in securities over a three-year period. This offering structure is intended for growth companies that are seeking to raise capital from a broader range of investors, including the general public.

There are certain requirements companies must meet to conduct a Reg A Tier 2 offering. These include filing an offering statement with the Securities and Exchange Commission (SEC) and/but/so providing ongoing disclosures to investors. The SEC reviews these filings and conducts its own due diligence to ensure that the offering is conducted legally/properly/fairly.

Regulating a Text Online

When it comes to regulating a text textual, there are several factors to consider. It's crucial to strike a balance between {freedomof expression and the need to prevent undesirable content. This can demand enforcing guidelines that precisely outline acceptable language.

, Additionally, it's important to develop processes for screening content and addressing breaches. This can comprise methods that automatically identify concerning content.

However, it's essential to guarantee accountability in the control process. This implies transparently communicating policies to users and offering platforms for input.

Oversight A+ Offering

A comprehensive framework A+ offering is essential for ensuring a trustworthy market . It minimizes risks by establishing clear guidelines for actors. This helps encourage development while safeguarding the security of all individuals involved. A effective regulation A+ offering can accelerate market transformation by creating a transparent environment that encourages engagement.

Ordinance A Plus

Achieving a truly robust infrastructure requires more than just basic adherence. Regulation A Plus goes beyond the fundamental requirements, striving for an environment of continuous optimization. By encouraging innovation and accountability, Regulation A Plus creates a positive outcome situation for both entities and the public they serve.

- Benefits of Regulation A Plus:

- Enhanced confidence among stakeholders

- Amplified efficiency

- Minimized uncertainty

Rule A vs Reg D

When it comes to raising capital, businesses often face a choice between Regulation A and Reg D. Both/Each of these securities laws/regulations/methods offer unique advantages and disadvantages that must be considered carefully/should be weighed, depending on the specific needs of the company. Regulation A, also known as a mini-IPO, is designed to facilitate/streamline/enable fundraising for smaller businesses by allowing them to raise funds publicly/offering a public offering/going public. On the other hand/Conversely, Regulation D is typically used by private companies/startups/emerging businesses to raise capital privately/secure funding from accredited investors/attract investment without going public. Understanding the key differences between these two regulations can help businesses make an informed decision/choose the best path forward/determine the most suitable option for their capital raising strategy/funding needs/financial goals.

Directive A

FRB Regulation A, also known as the Community Reinvestment Act, sets standards for financial institutions in order to meet the credit needs of their communities. This regulation encourages responsible lending practices and aids affordable housing development . Institutions that fail to meet the standards of Regulation A may face penalties.

Revised “Reg A+” Rules for Crowdfunding

The Securities and Exchange Commission (SEC) has approved new regulations under Regulation A+, opening opportunities for companies to raise capital through equity crowdfunding. These modified rules are intended to streamline the process for both businesses and investors, while enhancing investor safeguards. The SEC believes that these changes will stimulate economic growth by granting small businesses with access to capital.

These key changes include: raising the amount of capital companies can raise under Reg A+, loosening certain reporting requirements, and granting more choices for companies in how they design their offerings. The SEC anticipates that these changes will generate a increase in Reg A+ utilizations.

Offering Rules A+ vs Rule D

Navigating the world of financial laws can be a complex endeavor, especially when it comes to private offerings . Two prominent provisions , Regulation A+ and Regulation D, provide distinct pathways for companies seeking to raise capital from investors. Understanding the key distinctions between these two regulatory structures is crucial for both issuers and investors alike.

Regulation A+, a relatively new provision , offers a more accessible route for smaller companies to secure funding . It allows them to publicly offer their securities to a broader audience with less stringent reporting obligations . In contrast, Regulation D focuses on private securities sales and is typically utilized by companies seeking funding from a limited number of accredited individuals .

Within Regulation D, Rule 506(b) and Rule 506(c) represent two distinct approaches to private offerings . Rule 506(b) permits general solicitation of the offering, but relies on a due diligence process to confirm the accredited status of all individuals. Rule 506(c), conversely, prohibits general solicitation and instead mandates that all investors be identified as accredited through a rigorous process .

- Securities Regulations A+ aims to streamline the public offering process for smaller companies.

- Rule D facilitates private placements among a limited number of accredited investors.

- Rule 506(b) permits general solicitation but requires due diligence on investor accreditation.

- Rule 506(c) prohibits general solicitation and mandates accredited investor verification through a formal process.

For companies seeking to secure funding , understanding the nuances of Regulation A+ vs. Regulation D, including the distinctions between Rule 506(b) and Rule 506(c), is essential for making an informed selection. Consulting with experienced securities attorneys can provide valuable guidance throughout the process.

Unlock DreamFunded Resources on Regulation A+

Regulation A+ presents a unique avenue for financiers to fund to promising businesses. DreamFunded, a leading platform, concentrates in facilitating these deals through its robust resources. If you're a seasoned investor or just starting your journey in Regulation A+, DreamFunded's collection of guides can equip you with the knowledge needed to master this changing market.

- Explore key ideas of Regulation A+ and its rules

- Comprehend what to assess promising capitalization opportunities

- Obtain exposure to a network of experienced investors and professionals

Over-the-Counter (OTC) Markets

OTC Markets offer a realm for stocks to be traded outside of the regulated exchanges, such as the New York Stock Exchange or NASDAQ. These markets provide liquidity to a wider range of companies, featuring smaller, emerging, or less established businesses that may not meet the stringent listing requirements of traditional exchanges. Trading on OTC Markets is often conducted electronically, and prices are set by supply and demand in the marketplace.

- Participants interested in exploring opportunities on OTC Markets should conduct thorough research, understand the risks involved, and seek professional guidance as needed.

The Rise of Equity Crowdfunding and its Impact on Startups Funding

Crowdfunding has revolutionized the way Entrepreneurs raise Capital. Platforms like GoFundMe, Kickstarter, and Indiegogo have made it possible for anyone to Invest to projects they believe in. This has opened up new Opportunities for New companies to Raise capital.

Equity crowdfunding, a specific type of crowdfunding where investors receive Equity in the company in return for their Contribution, has become increasingly popular. This allows Businesses to Utilize larger sums of Capital than they could through traditional Lending.

The JOBS Act (Jumpstart Our Business Startups) and its related regulations, including Reg A+, have made it easier for Companies to conduct equity crowdfunding. The SEC (Securities Exchange Commission) now provides Guidelines that govern these Deals.

Websites like EquityNet and CircleUp connect investors with promising Ventures. AngelList, another popular platform, facilitates connections between Entrepeneurs and Seed companies.

These platforms have created a more Democratized Investment landscape, allowing individuals to participate in the growth of Tech companies and other exciting ventures.

However, it's important for investors to conduct thorough Investigation before Investing in any crowdfunding campaign. Understanding the Challenges involved is crucial to making informed Selections.

The future of equity crowdfunding looks bright. As regulations evolve and platforms continue to innovate, we can expect to see even more Businesses leverage this powerful tool to Expand.

Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Raquel Welch Then & Now!

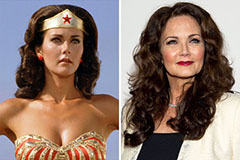

Raquel Welch Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Rachael Leigh Cook Then & Now!

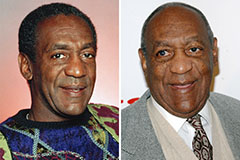

Rachael Leigh Cook Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!